Shares are also close to most analyst price targets, although official ratings remain positive. This will mark its second stock split in the 5-years since splitting in early 2006. NVIDIA now has a market cap of $18.4 Billion after shares have risen well over 300% in the last 5-years and are still up roughly 150% since the start of 2006. The drop today takes it almost 7% off of highs and almost 4% off of the recent high close.Īs a reminder, both NVIDIA and Advanced Micro Devices’ (NYSE:AMD) ATIunit are both within about 60 days of now for their graphic chipsets.There are mixed reports and this may just boil down to preference oropinion, but most have commented that NVIDIA still has the advantage. Shares often trade up going into a stock split, but in less than one-month shares saw roughly a 30% gain in only three different weeks. It also now has its earnings behind us as well. On August 10, shares closed at $43.99 and they closed as low as $42.57 on August 16. But up until today shares had been on a tear and traded as high as $54.00 just on Wednesday. NVDA Chart Analysis NVDA, 1D Short MannyTman Premium Updated Sep 29 NVDA has formed a descending channel on the daily time frame with a target of 120. Shares are down today with a crummy stock market and after National Semi numbers and Xilinx guidance. (NASDAQ:NVDA) will trade on an ex-split basis to reflect its 3-for-2 stock split that it declared on August 9. His Substack newsletter, TLV Strategist, covers the Israel business scene.On Tuesday morning, September 11, 2007, shares of NVIDIA Corp. The split will come in the form of a stock dividend, distributing three additional shares of common stock for every share investors own as of close of business on June 21. InvestorPlace contributor Robert Lakin is a veteran financial writer and editor, including previous stints with Bloomberg News and as a buyside equity research editor. The opinions expressed in this article are those of the writer, subject to the Publishing Guidelines. On the date of publication, Robert Lakin did not have (either directly or indirectly) any positions in the securities mentioned in this article. Data center sales were up 79% from last year to $2.05 billion. At Truist, analyst William Stein has raised his price target to $910 and has a “buy” rating on NVDA shares.Įarlier this year, Nvidia said revenue from chips used for gaming, which make up about half of its overall total, rose 106% from last year to $2.76 billion, while sales of its CMP product line, the choice of crypto miners, came in at $155 million. Rick Schafer, an Oppenheimer analyst has a price target of $925 with an “outperform” rating. Nvidias paying 40 billion for UK-based ARM Holdings. Shares opened at 70250 on 7 June 20 higher than their 58550 valuation on 20 May one day before the stock split announcement. The analyst believes that the gaming demand will remain robust and will drive sales. NVDA stock is up 10 in the two weeks since those impressive results. KeyBanc analyst John Vinh has an “overweight” rating with a price target of $950. Wall Street continue to see only green for Nvidia, as 26 out of 27 analysts rate it a “buy,” according to Tipranks. In April, Nvidia unveiled its first central processing unit (CPU), called Grace, which uses Arm’s chip designs for high-end computing and AI applications. In September, Nvidia unveiled new GeForce gaming graphics processing units (GPUs). It also will become a major player as a provider for the chip industry and will rule the world of artificial intelligence (AI). But 2022 has been terrible for the chipmaker thanks to an oversupply in the graphics card market that has dealt a. Once this deal closes, Nvidia will enjoy a competitive advantage in the industry. Nvidias stock price also took off following its 4-for-1 split on July 20, 2021. 236 fib level, which is now 185 approximately. Once it adjusted and all of the speculative traders jumped ship, Nvidia found itself spending most of the day battling at our.

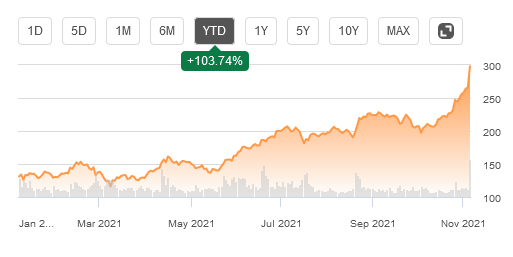

This means the odds of closing by the March 2022 deadline are falling by the day. So things got a little weird today at the open with the stock split as many traders checked their holdings to see NVDA down -70 today. The European Commission needs until September to gather information before it can accept a formal application. The tech maker is pushing ahead with its $40 billion acquisition of UK-based chipmaker Arm, despite reports last month that the deal could go south. NVDA is the largest holding in the exchange-traded fund’s 32-stock portfolio, at a 9.24% weight. By comparison, the iShares Semiconductor ETF (NASDAQ: SOXX) has increased 12.8%. The split comes as the shares have gained about 43% this year, fueled by demand for data-center chips and its technology that’s favored by gamers and cryptocurrency miners.

0 kommentar(er)

0 kommentar(er)